Opportunity Zone

The Tax Cuts and Jobs Act of 2017 established Opportunity Zones as a mechanism to provide tax incentives for investment in designated U.S. Census Tracts. Investments made by individuals through special funds in these zones would be allowed to defer or eliminate federal taxes on capital gains.

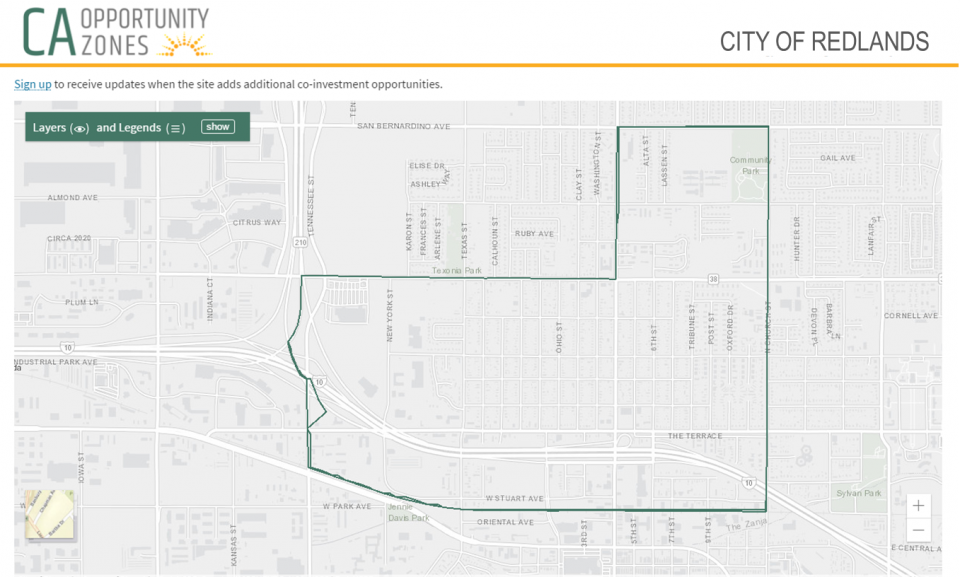

The City of Redlands has one (1) Opportunity Zone, which includes Census Tract 80.02, identified in the map below.

To learn more about Opportunity Zones, please visit the following resources for additional information:

Internal Revenue Service (IRS): irs.gov/newsroom/opportunity-zones-frequently-asked-questions

State of California, Department of Finance (DOF):

dof.ca.gov/Forecasting/Demographics/california_opportunity_zones

State of California Opportunity Zone Portal:

opzones.ca.gov

California Association for Local Economic Development:

caled.org/opportunity-zone-resources

For additional information and development opportunities, please contact Economic Development at (909) 335-4755 ext. 1.