Mills Act Program

Historic Preservation Contract

The City of Redlands invites applications from property owners to participate in the city’s Mills Act program, designed to encourage the preservation of historic properties in Redlands.

About

The Mills Act Program is an economic incentive program statewide in California for the restoration and preservation of qualified historic buildings by private property owners. Participation by the City in the California Mills Act Program was approved by the City Council on November 20, 2012.

What can be included?

The focus of the program is preserving, maintaining, and/or restoring the significant features that define the historical character of the property (such as structural and architectural elements). The property owner promises to make improvements that will not detrimentally affect the architectural, historical, or aesthetic integrity of the property.

Some typical types of building elements that are usually eligible to be included in the Ten-Year Work Plan are:

- Foundation (including seismic retrofit)

- Roofs, awnings, balconies

- Exterior siding, paint, finishes

- Exterior windows and doors

- Porches, patios, exterior stairs

- Code-required repairs or replacements (e.g., knob & tube wiring)

- Other documented contributing elements unique to the property (e.g., rock wall)

Some types improvements or property elements that are usually not eligible for the Ten-Year Work Plan include:

- Fences, walls, or gates

- Walkways or lighting

- Landscape or drainage improvements

- Non-contributing elements not related to historical preservation of the structure or house

- Interior work such as aesthetic improvements (e.g., kitchen, bathroom, living room, bedroom upgrades)

- New interior flooring, paint, wallpaper, countertops, cabinets, fixtures, etc.

- Replacing appliances, HVAC systems, duct work, water heaters, etc.

California Mills Act Program

The California Mills Act Program was first enacted in 1972, and grants participating cities and counties the authority to enter into contracts with owners of qualified historic properties who actively participate in the rehabilitation, restoration, preservation, and maintenance of their historic properties. Since the costs of doing so can be high, and ultimately have the effect of prohibiting preservation activities, property tax relief can offset these costs. Thus, the Mills Act program is offered as a strong incentive for property preservation work.

Additional information about the statewide program is available from the State Office of Historic Preservation, Mills Act Program website (click here), or go to www.ohp.parks.ca.gov for the California Office of Historic Preservation.

Property Tax Savings

Property taxes are recalculated using a formula in the Mills Act and State Revenue and Taxation Code. The average savings for individual properties under the Mills Act contract is between 20 and 60 percent. The full amount of the tax savings received by the property owners must be used to finance the preservation, maintenance, and improvements to the property.

If a property owner defaults on the terms or conditions, the City may choose to not renew the contract or cancel the contract (and the owner would be subject to a cancellation fee, usually an amount equal to 12.5% of the current fair market value of the property).

Eligibility

The eligibility and program guidelines include:

- Property must be located in the City of Redlands;

- Property must be privately owned;

- The property is not currently exempt from taxation;

- The property is listed in a Federal, State or City

official register pursuant to Calif, Gov. Code 50280.1

(Note: If the property is not currently designated as a historic resource, then an additional application may be processed concurrently to have the City Council approve its designation and include it in the City’s list of Local Historic Resources to make the property eligible for a Mills Act Contract); - Significant features that define the historical character of the property and its buildings have not been destroyed or can be restored based on documentary, physical, or pictorial evidence;

- The owner of the property proposes to make significant improvements to the property that will not impact the architectural, historical, or aesthetic integrity of the property;

- The property owner agrees to enter into a 10-year contract, and have the contract recorded with the County Assessor; and

- The property owner agrees to submit documentation every year to the Planning Division that allows the City to conduct an annual review of the work completed and evaluate compliance with the contract.

- Currently, there is no valuation limit for single-family properties. The City Council removed the previous restriction (valuation not to exceed $1 million) when they updated the program requirements in 2019 (Resolution No. 7947).

Review and Approval Process

After filing an application for a Mills Act contract and all necessary information has been submitted, the application will be reviewed by the city’s Historic & Scenic Preservation Commission for a recommendation to the City Council. The City Council would then hold a public hearing and make a final decision on the Mills Act contract. Overall, the process typically takes about 3 to 4 months (due to the preparation and lead time necessary for public hearings).

The City may approve up to seven (7) applications per year, consisting of five (5) residential properties and two (2) commercial properties.

Each contract that is approved will include a term of ten (10) years. At the end of each year, it will renew automatically and add one year (for an on-going length of 10 years).

Annual Reporting

Each property owner with a Mills Act contract will be required to prepare and submit an annual report to verify compliance with their contract. The annual report assures that the property is meeting its obligations to implement the 10-Year Work Plan included in the Mills Act contract.

Annual Report fillable form - Mills Act

Hint: Download and save the template to your desktop first, then begin completing the document. Fields shown outlined in Red are required fields and must be completed.

What information is required?

The Annual Report must include the following:

- Brief description of the improvements completed during the previous 12 months;

- Photo documentation of work completed during the previous 12 months;

- Copy of all receipts and checks (i.e., proof of payment) for improvements to verify all costs expended during the previous 12 months; and,

- Copy of applicable tax statements (Assessment Notice and the Tax Collector Bill).

When is the Annual Report due?

Annual reports must be submitted to the Planning Division no later than the last business day in July each year. Annual reports may be dropped off or submitted to the city’s Planning Division, to the attention of the Historic Preservation Officer.

The fillable form above is provided for your convenience, and can be downloaded to your desktop (before completing the form). If you have any questions about the format or content required for the Annual Report, please contact the planner at the One Stop Permit Center at (909) 798 – 7551 extension 3.

Application Form

Click here to download the Mills Act Application

The application form is available online as well as at the Planning Division public counter at the One Stop Permit Center (click here) located at 35 Cajon Street, Suite 15-A, in the Redlands Civic Center. The form available for download (click on link above) includes fillable boxes and formulas to assist applicants with completing the form. The application fee is $820.00 (click here for the Fee Schedule).

For further information or if you have any questions, please contact the planner at the One Stop Permit Center at (909) 798 – 7551 extension 3.

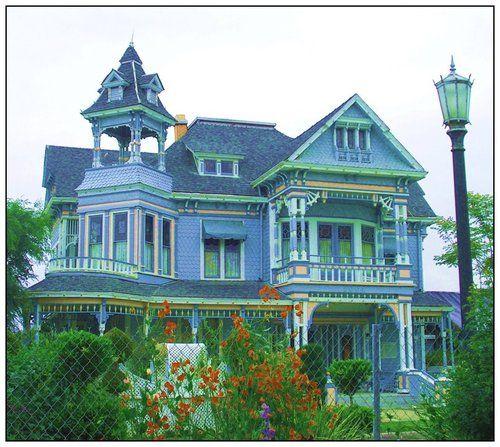

Examples

Typical properties in Redlands that could take advantage of the Mills Act Program include the following.

Sample Contract

Click here to view a sample of a Mills Act Contract

Other Links

State Historic Preservation Tax Credit (Calif. Office of Historic Preservation)